After more than four years of hard-fought litigation, the City of Miami entered into and a Miami-Dade Circuit Court judge gave final approval to, a $12 million settlement agreement stemming from a class action lawsuit brought by property owners who were denied tax exemptions.

The property owners claimed they were entitled to those exemptions as a result of a city ordinance granting tax exemptions to businesses that opened or expanded inside Miami’s Enterprise Zone. The purpose of the ordinance was to incentivize regentrification and job stimulation in depressed neighborhoods within the city.

Business owners alleged the city violated its own ordinance by refusing to review their applications for the tax exemption and by failing or refusing to recommend the applications for approval or denial by the city commission. The plaintiffs claimed they were instrumental in helping to revitalize the area, which in turn brought significant financial benefits to the city. The tax breaks were worth up to 100 percent of the assessed value of their improvements.

The suit was filed in 2013 on behalf of 346 NW 29th Street LLC (d/b/a/ Museo Vault) and in April 2015 was granted class certification. Included in the class were: Braman Motors, Met II Office and Met II Hotel, Epic Hotel, Midtown, Jungle Island and Publix at Brickell.

The city challenged the class certification to the Third DCA and lost. There were numerous failed court challenges brought by city, including two appeals at the Third District Court of Appeal and an attempted third appeal to the Florida Supreme Court.

Settlement discussions initially began in August 2017 and an agreement was reached. However, it still needed the blessing of the city commission, which took place in early 2018 and finally was approved by a circuit court judge in late 2018. The claims will be determined by a mutually appointed administrator and special master.

The case is important because it reinforces the right of citizens to hold the government accountable for following its own laws. It should set a precedent for municipalities to heed their own ordinances, laws and legal obligations to their communities.

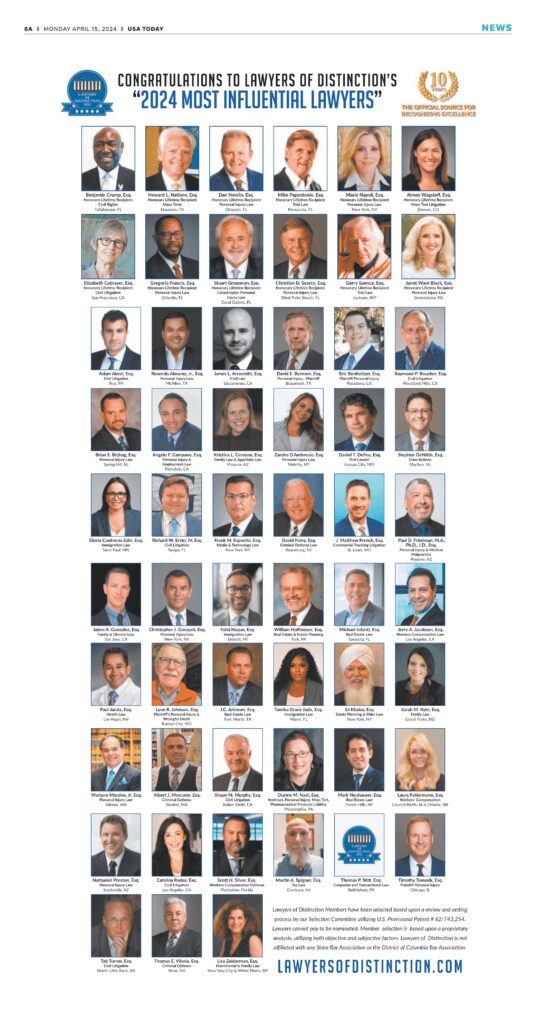

The case was handled by Lawyers of Distinction member Stevan Pardo, Esq.

Learn more about the Lawyers of Distinction Selection Process

Learn more about the benefits of being a Lawyer of Distinction