The rapid rise of blockchain technology and cryptocurrency has transformed industries and created new legal challenges. While these technologies promise decentralization and transparency, they also raise significant concerns related to regulation, data security, and enforcement. As blockchain networks and cryptocurrencies become more mainstream, lawyers must understand the emerging legal trends and challenges to effectively navigate this evolving landscape.

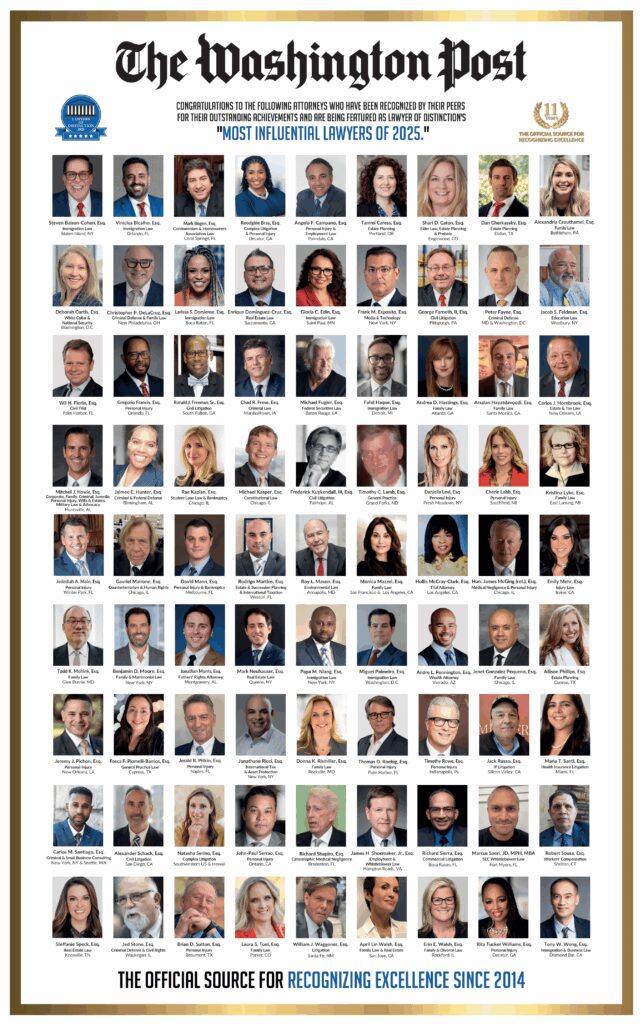

At Lawyers of Distinction, we recognize the growing importance of blockchain and cryptocurrency in the legal realm. Our members, who hail from all over the United States, are equipped to tackle the complex legal issues arising from these technologies. Whether it’s regulatory compliance, smart contract disputes, or cybersecurity, our members are ready to assist clients in navigating this new frontier. If you’re facing legal challenges in the blockchain or cryptocurrency space, our team can provide the guidance and expertise you need.

Understanding Blockchain And Cryptocurrency Regulation

Blockchain technology and cryptocurrencies operate in a decentralized environment, often bypassing traditional, financial institutions, systems and regulations. However, this has led to a patchwork of regulations across different jurisdictions, making regulatory compliance a significant challenge. For instance, in the United States, the Securities and Exchange Commission (SEC) considers some cryptocurrencies as securities, subjecting them to federal securities laws. Meanwhile, the Internal Revenue Service (IRS) views cryptocurrency as property, leading to complex tax reporting requirements.

Internationally, the regulatory landscape is even more varied. The European Union, for example, has introduced the Markets in Crypto-Assets Regulation (MiCA) to provide a comprehensive regulatory framework. In contrast, some countries have outright banned cryptocurrency trading and mining. Lawyers must stay updated on these regulations and advise clients on how to remain compliant with local laws compliance regulations while operating in the global marketplace.

The ambiguity surrounding the classification of cryptocurrencies like Bitcoin blockchain and other virtual currencies also adds to the regulatory compliance challenges. Are they commodities, securities, or something else entirely? The answer often depends on the specific characteristics of the digital currency in question. This classification affects how these assets are regulated, taxed, and treated under the law. As such, legal professionals must be prepared to navigate these nuances to provide sound legal advice.

Smart Contracts: Opportunities And Legal Complexities

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically enforce and execute the contract when the agreed-upon conditions are met, reducing the need for a trusted third party. While this technology offers efficiency and transparency, it also presents unique legal challenges.

One of the primary concerns with smart contracts is the issue of enforceability. Traditional contracts are governed by established legal principles, but smart contracts operate within the blockchain protocol’s logic. If a dispute arises, courts may struggle to interpret or enforce these contracts, especially if the code contains errors or ambiguities. Lawyers must understand the technical aspects of smart contracts to advise clients on potential risks and ensure that these contracts are legally enforceable.

Another challenge is the cross-jurisdictional nature of smart contracts. Since they can be executed across borders without the need for intermediaries, determining the applicable law and jurisdiction can be complicated. This raises questions about which legal standards apply and how disputes should be resolved. Lawyers must carefully draft smart contracts to address these legal issues and ensure that their clients are protected.

Moreover, the immutability of blockchain records poses challenges in amending or terminating smart contracts. Unlike traditional contracts, which can be modified through mutual agreement, altering a smart contract after it has been deployed on the blockchain is difficult. This immutability can lead to unintended consequences if circumstances change or if the contract contains errors. Legal professionals must consider these factors when advising clients on the use of smart contracts.

Cryptocurrency And Cybersecurity: Navigating Legal Risks

Cryptocurrency transactions rely on blockchain technology, which is generally secure due to its decentralized nature and cryptographic protocols. However, the rise of cryptocurrency has also attracted cyber criminals, leading to an increase in hacking incidents, fraud, and other security breaches. Legal issues surrounding cybersecurity in the cryptocurrency space are becoming increasingly important.

One of the main concerns is the legal responsibility for security breaches. If a cryptocurrency exchange is hacked, resulting in the loss of funds, who is liable? The exchange? The user? These legal questions are still being debated in courts, and the lack of clear legal precedents makes it challenging for lawyers to provide definitive answers. As such, legal professionals must stay informed about the latest developments in cybersecurity law and advise clients on best practices to mitigate risks.

Another issue is the anonymity of cryptocurrency transactions on public and private blockchains and networks. While blockchain technology provides transparency, the anonymity of users can make it difficult to track and prosecute cybercriminals. This raises legal challenges in identifying the parties involved in illegal activities, such as money laundering or terrorist financing. Lawyers must be prepared to work with law enforcement agencies and understand the legal tools available to trace and recover stolen assets.

Furthermore, the decentralized nature of blockchain technology complicates the enforcement of cybersecurity regulations. Since there is no central authority controlling the blockchain network, traditional regulatory approaches may not be effective. Legal professionals must explore new ways to address these challenges, such as through collaboration with international organizations and the development of blockchain implementation of industry-specific regulations.

Intellectual Property Rights And Blockchain

Blockchain technology has the potential to revolutionize the way intellectual property (IP) rights are managed and enforced. By creating a transparent and immutable record of ownership, blockchain can help reduce instances of IP infringement and streamline the process of licensing and royalty distribution. However, the intersection of blockchain and IP law is still in its early stages, and several challenges remain.

One challenge is the question of who owns the data stored on a blockchain. In a decentralized system, multiple parties may have a stake in the data, leading to disputes over ownership and control. Additionally, the use of blockchain to record IP rights raises concerns about privacy and data protection, as sensitive information may be exposed on a public, distributed ledger.

Another issue is the enforcement of IP rights on a blockchain network. While a blockchain protocol can provide proof of ownership, it does not automatically prevent unauthorized use or reproduction of the content. Legal professionals must work to integrate blockchain technology with existing IP laws and explore new legal frameworks to ensure that IP rights are adequately protected in the digital age.

The Role Of Blockchain In Financial Services

The financial services industry has been one of the earliest adopters of blockchain technology, recognizing its potential to enhance transparency, reduce costs, and increase the efficiency of financial transactions. From cross-border payments to trade finance to corporate, blockchain is being used to create more secure and efficient financial systems. However, the integration of blockchain into financial services also presents unique legal challenges.

One of the primary legal concerns is the regulation of blockchain-based financial products and services. As financial regulators around the world grapple with how to classify and regulate these new technologies, legal professionals must stay informed about the evolving regulatory landscape. This includes understanding the implications of anti-money laundering (AML) and know-your-customer (KYC) regulations consortium blockchain, as well as the impact of blockchain on consumer protection laws.

Another challenge is the potential for disputes arising from the use of blockchain in financial transactions. As with any new technology, there is a risk of technical failures, hacking, or other issues that could lead to financial losses. Legal professionals must be prepared to handle disputes related to blockchain-based financial services and advise clients on how to mitigate these risks.

Blockchain And Data Privacy: Legal Implications

Data privacy is a critical issue in the digital age, and blockchain technology presents both opportunities and challenges in this area. On one hand, blockchain can enhance data security by providing a decentralized and immutable record of transactions. On the other hand, the transparency of blockchain can conflict with data privacy regulations, such as the General Data Protection Regulation (GDPR) in the European Union.

One of the main legal challenges is the issue of data permanence. Once data is recorded on a blockchain, it is difficult, if not impossible, to delete or modify. This raises questions about how to comply with data protection laws that require the right to be forgotten or the ability to correct inaccurate data. Legal professionals must navigate these challenges and explore ways to reconcile blockchain technology with data privacy regulations.

Another concern is the potential for misuse of personal data on a blockchain network. While blockchain can provide greater transparency in storing data, it can also expose sensitive information to unauthorized parties. Legal professionals must advise clients on how to protect personal data on a blockchain and ensure compliance with data protection laws.

Blockchain In Supply Chain Management: Legal Considerations

Blockchain technology has the potential to transform supply chains by providing greater transparency, traceability, and efficiency. By using distributed ledger technology to create a decentralized and immutable record of transactions, blockchain eliminates fraud, improves accountability, and enhances trust between supply chain partners. However, the use of blockchain in supply chain management also presents legal challenges.

One challenge is the issue of liability. In a traditional supply chain, liability for defects or delays can often be traced to a specific party. However, in a decentralized blockchain-based supply chain, determining liability can be more complicated. Legal professionals must work to develop new legal frameworks for assigning liability and resolving disputes in a blockchain-based supply chain.

Another concern is the enforceability of contracts in a blockchain-based supply chain. While smart contracts can automate the execution of contractual obligations, they may not always be legally enforceable. Legal professionals must advise clients on how to ensure that smart contracts in a supply chain context comply with applicable laws and can be enforced in the event of a dispute.

Blockchain And Taxation: Navigating Complex Legal Terrain

The rise of blockchain technology and cryptocurrency has created new challenges for tax authorities and legal professionals. The decentralized and anonymous nature of blockchain project’s cryptocurrency transactions can make it difficult for tax authorities to track and enforce tax compliance. Legal professionals must stay informed about the evolving tax laws related to blockchain and cryptocurrency and advise clients on how to comply with their tax obligations.

One of the main legal challenges is the classification of cryptocurrency for tax purposes. In the United States, the IRS treats cryptocurrency as property, which means that each transaction involving cryptocurrency may be subject to capital gains tax. However, the tax treatment of cryptocurrency varies from country to country, and legal professionals must advise clients on the tax implications of their cryptocurrency transactions in different jurisdictions.

Another challenge is the reporting of cryptocurrency transactions. Given the anonymity and complexity of cryptocurrency transactions on networks like the Ethereum blockchain, many taxpayers may not fully understand their tax reporting obligations. Legal professionals must work with clients to ensure that they accurately report their cryptocurrency transactions and avoid potential penalties for non-compliance.

The Future of Blockchain in Government and Public Services

Blockchain technology has the potential to revolutionize government and public services by providing greater transparency, efficiency, and accountability. From voting systems to land registries, blockchain is being explored as a way to improve the delivery of public services and enhance trust in businesses and government institutions. However, the adoption of blockchain in government also presents significant legal challenges.

One of the main challenges is the issue of governance. In a decentralized blockchain system, there is no central authority to oversee the system and enforce rules. This raises questions about how to ensure the integrity and security of blockchain-based public services. Legal professionals must work with government agencies to develop new governance frameworks for blockchain-based public services.

Another challenge is the potential for privacy and security risks. While blockchain can provide greater transparency, it can also expose sensitive information to unauthorized parties. Legal professionals must advise government agencies on how to protect personal data and ensure compliance with data protection laws when implementing blockchain-based public services.

Blockchain And The Environment: Legal And Ethical Considerations

The environmental impact of blockchain technology, particularly in the context of cryptocurrency mining, has become a growing concern. The energy consumed in the process of mining cryptocurrencies like Bitcoin has led to increased scrutiny of the environmental footprint of blockchain technology. Legal professionals must be aware of the legal and ethical implications of blockchain’s environmental impact and advise clients accordingly.

One of the key legal challenges is the regulation of cryptocurrency mining activities. In some jurisdictions, governments have imposed restrictions or bans on cryptocurrency mining due to its environmental impact. Legal professionals must stay informed about these regulations and advise clients on how to comply with environmental laws while engaging in cryptocurrency mining.

Another issue is the potential for environmental liability. If a company’s blockchain-related activities are found to cause environmental harm, they may be held liable for damages. Legal professionals must work with clients to assess the environmental impact of their blockchain activities and develop strategies to mitigate potential legal risks.

Blockchain And Cross-Border Transactions: Legal Challenges

Blockchain technology could transform cross-border transactions by enabling faster, more efficient, and more secure international trade. However, the use of blockchain in cross-border transactions also presents significant legal challenges, particularly concerning jurisdiction and the enforcement of contracts.

One of the main challenges is the issue of jurisdiction. Since blockchain transactions can be executed across borders without intermediaries, it can be difficult to determine which country’s laws apply in the event of a dispute. Legal professionals must work with clients to identify the applicable jurisdiction and ensure that contracts are enforceable in the relevant legal system.

Another challenge is the enforcement of cross-border contracts on a blockchain. While blockchain technology can automate the execution of contracts, enforcing these contracts across different jurisdictions can be complicated. Legal professionals must advise clients on how to draft contracts that are enforceable in multiple jurisdictions and ensure compliance with international trade laws.

Blockchain And Consumer Protection: Legal Considerations

As blockchain technology becomes more widely adopted, consumer protection has become an increasingly important issue. Consumers may not fully understand the risks associated with blockchain-based products and services, leading to potential disputes and legal challenges. Legal professionals must work to protect consumers and ensure that blockchain technology is used in a way that is fair and transparent.

One of the main legal challenges is the issue of disclosure and transparency. Consumers may not fully understand how blockchain technology works or the risks associated with using blockchain-based products and services. Legal professionals must work with companies to ensure that they provide clear and accurate information to consumers and comply with consumer protection laws.

Another challenge is the potential for fraud and deception in the blockchain space. The decentralized and anonymous nature of blockchain can make it difficult to detect and prevent fraudulent activities. Legal professionals must work to develop new legal frameworks for consumer protection in the blockchain space and advise clients on how to protect consumers from fraud and deception.

Blockchain And The Real Estate Industry: Legal Implications

Blockchain technology is beginning to make inroads into the real estate industry, offering the potential to streamline transactions, reduce costs, and increase transparency. From property title transfers to rental agreements, blockchain is being used to create more efficient and secure real estate transactions. However, the use of blockchain in real estate also presents unique legal challenges.

One of the main legal challenges is the issue of title ownership and transfer. Blockchain technology can provide a transparent and immutable record of property ownership, reducing the risk of fraud and disputes. However, legal professionals must ensure that blockchain-based title transfers comply with existing property laws and are legally enforceable.

Another challenge is the integration of smart contracts in real estate transactions. Smart contracts can automate the execution of real estate agreements, but they may not always be legally enforceable. Legal professionals must work to ensure that smart contracts in real estate transactions comply with applicable laws and provide the necessary protections for all parties involved.

Blockchain In Healthcare: Navigating Legal And Regulatory Hurdles

The healthcare industry is exploring the use of blockchain technology to improve patient data management, enhance the security of health records, and streamline administrative processes. Blockchain offers the potential to create a more efficient and secure healthcare system, but it also presents significant legal and regulatory challenges.

One of the main legal challenges is the issue of data privacy and security. Blockchain can provide a secure and transparent way to manage patient data, but it also raises concerns about compliance with data protection laws such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Legal professionals must work with healthcare service providers to ensure that blockchain-based systems comply with data privacy regulations and protect patient information.

Another challenge is the regulation of blockchain-based healthcare services. As blockchain technology becomes more widely adopted in the healthcare industry, regulators are grappling with how to classify and regulate these new services. Legal professionals must stay informed about the evolving regulatory landscape and advise clients on how to comply with healthcare regulations while implementing blockchain technology.

Legal Risks Of Decentralized Autonomous Organizations (DAOs)

Decentralized Autonomous Organizations (DAOs) represent a new and innovative application of blockchain technology, allowing for the creation of organizations and resources that operate without centralized control. DAOs rely on smart contracts to automate decision-making processes and governance, offering the potential for greater transparency and efficiency. However, the legal status of DAOs remains uncertain, presenting significant legal risks for participants.

One of the main legal challenges is the issue of liability. Since DAOs operate without centralized control, it can be difficult to determine who is liable in the event of a dispute or legal violation. Legal professionals must work with clients to assess the legal risks associated with participating in a DAO and develop strategies to mitigate potential liability.

Another challenge is the regulatory uncertainty surrounding DAOs. In many jurisdictions, the legal status of DAOs is not clearly defined, leading to uncertainty about how they are regulated and taxed. Legal professionals must stay informed about the evolving regulatory landscape and advise clients on how to navigate the legal challenges associated with DAOs.

Why Choose Lawyers Of Distinction For Blockchain And Cryptocurrency Legal Matters?

Navigating the legal complexities of blockchain and cryptocurrency requires a deep understanding of both technology and law. At Lawyers of Distinction, our members are well-versed in the latest legal trends and challenges in this area. We offer a wide range of services, from regulatory compliance to dispute resolution, ensuring that our clients receive comprehensive legal support. Our national network of lawyers allows us to provide specialized expertise, regardless of your location or legal needs.

By choosing Lawyers of Distinction, you gain access to a distinguished group of legal professionals who are committed to excellence in the practice of law. Our members are recognized for their achievements and are dedicated to helping clients succeed in a rapidly changing legal landscape. If you need legal assistance with blockchain or cryptocurrency matters, contact us at (877) 335-3021 or through our contact form at https://www.lawyersofdistinction.com/contact/.